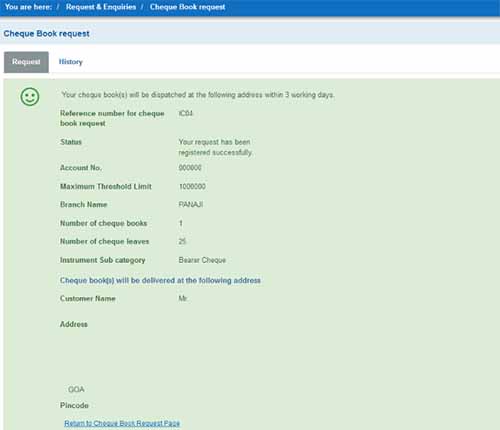

If it cannot come to an agreement with the bondholders soon, it is likely to become the first African country to default on its debts as a result of the coronavirus pandemic. Africa’s second largest copper producer is struggling to balance its payments amid dwindling copper revenues that provide 70 per cent of its export earnings. Zambia has said it will resist Chinese creditors to make paying arrears, a condition of pursuing debt-relief talks as it battles to restructure $11 billion of external debt. Zambia has asked its external creditors for debt-service suspension as the southern African nation edges to default highlighting the limitations of China’s debt diplomacy.

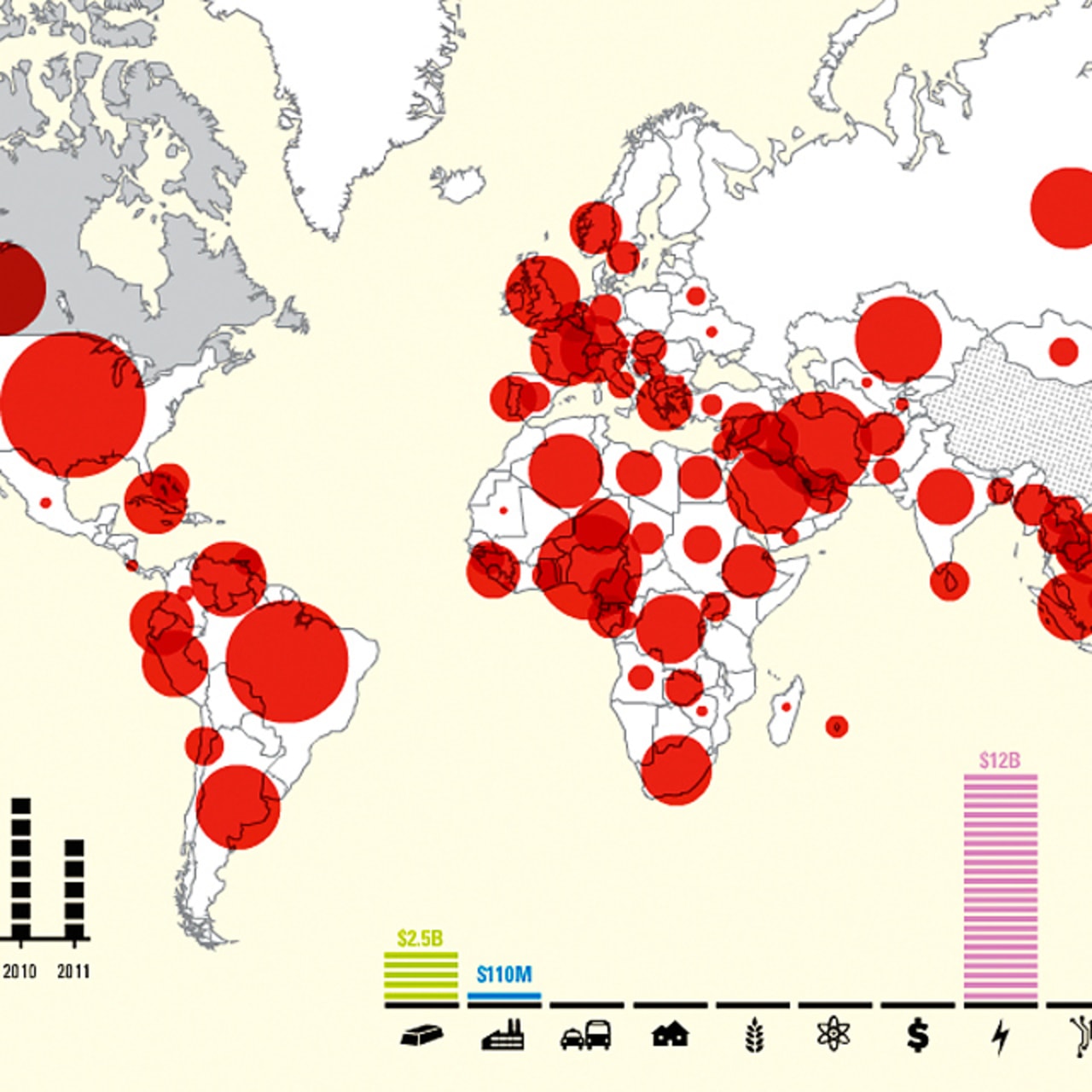

Sri Lanka, another borrower that has been buckling under the weight of its ballooning debt, Beijing has granted Colombo a two-year debt moratorium.īut it has not provided the required financing assurances for the IMF to step in, effectively blocking the institution from offering rescue loans to the country.Zambia risks losing sovereignty to Chinese chequebook diplomacy Over the years, once rosy relations between the two countries have soured as Beijing and Lusaka struggled to hammer out a debt relief deal as part of the G-20 Common Framework. Take Zambia, which defaulted on some USD 17 billion of debt in 2020 and counts China as its largest bilateral creditor. Unable to pay China back, some cash-strapped governments are pushing for debt relief, forgiveness, or restructuring. In 2017, China overtook the World Bank and the International Monetary Fund (IMF) to cement its position as the world's biggest creditor, although Beijing has since scaled back its lending.īut many of its borrowers-still reeling from the COVID-19 pandemic and Russia's war in Ukraine, alongside Beijing's lending practices-are now battling to pull their economies back from the brink, reported FP.Īround 60 per cent of China's overseas loans went to financially distressed countries in 2022, compared with just 5 per cent in 2010, according to Parks. If you want to have your money back, you want to force debt repayment, that basically means you are going to forgo the goodwill," said Zongyuan Zoe Liu, an international political economy expert at the Council on Foreign Relations. "I think China literally has to choose which side it wants to let go. That tension, experts say, has left Beijing facing an impossible trade-off: Can it collect its money without hurting its image?, reported FP.

Now, he said, "the developing world is getting to know China in a very new role-and that new role is as the world's largest official debt collector."Ĭhina is chasing down unpaid debts, complicating Beijing's broader aspirations of extending its influence and forging new relationships through economic deals. China has broken a few bones in Sri Lanka, whose financial turmoil allowed Beijing to seize control of a strategic port, and is hassling Pakistan, Zambia, and Suriname for repayment, reported FP.Īlso Read | Winter Storm Continues To Slam Much of US, While Some Parts Experience Record Heat.įor two decades, countries "were getting to know China as the kind of benevolent financier of big-ticket infrastructure," said Bradley Parks, the executive director of the AidData research group at William & Mary.

0 kommentar(er)

0 kommentar(er)